Supporting Components of the Tokenomics Rework

Anti-sock Puppet Effects

Rocket Pool currently has modest incentives to sock puppet. Due to the square root scaling, sock puppeting increases voting power. It also allows additional flexibility in RPL staking (eg, you could have some undercollateralized pools on one node and a separate collateralized node receiving RPL rewards).

As shown in Lower Bonds and Capital Efficiency, the bond curves make profitability increase as you have more validators on one node. This will give people a strong reason to avoid sock puppeting behavior. Note also, that getting rid of the RPL reward “cliff” also removes one possible reason to engage in sock puppeting.

Megapools

Currently, Rocket Pool minipools each have their own Ethereum contract. This results in high gas costs for node operators with several minipools (gas-intensive to launch or distribute rewards for several validators). The Saturn upgrade introduces megapools, where a single megapool contract is used as an Ethereum withdrawal address for multiple validators. This drastically reduces gas costs for launching or distributing rewards for several validators (by almost N times, where N is the number of validators the node operator is running).

Forced Exits

Currently, if a minipool is penalized, the protocol has no way to forcibly reclaim that bond. It can set a penalty, which will be enforced on the exit of the underlying validator. This means a rogue node operator could continue running their minipool profitably indefinitely after that point in time.

Saturn 2 includes forced exits, which allow the protocol to initialize the exit of a validator when certain conditions are met. This would allow the protocol to immediately reclaim a highly penalized bond, and prevent hypothetical rogue node operators from being a drag on the protocol.

Megapool Level Penalties

Currently, penalties can be applied on a per minipool basis. Consider a node operator with 4 LEB8 minipools that steals 30 ETH of MEV in one block. At this time, only that minipool will be penalized, and any other minipools that node operator has will be unaffected. This means that Rocket Pool could recover at most the 8 ETH bond from the LEB8 minipool that stole the block. With megapool level penalties, the bond from all of the validators in a megapool could be recovered.

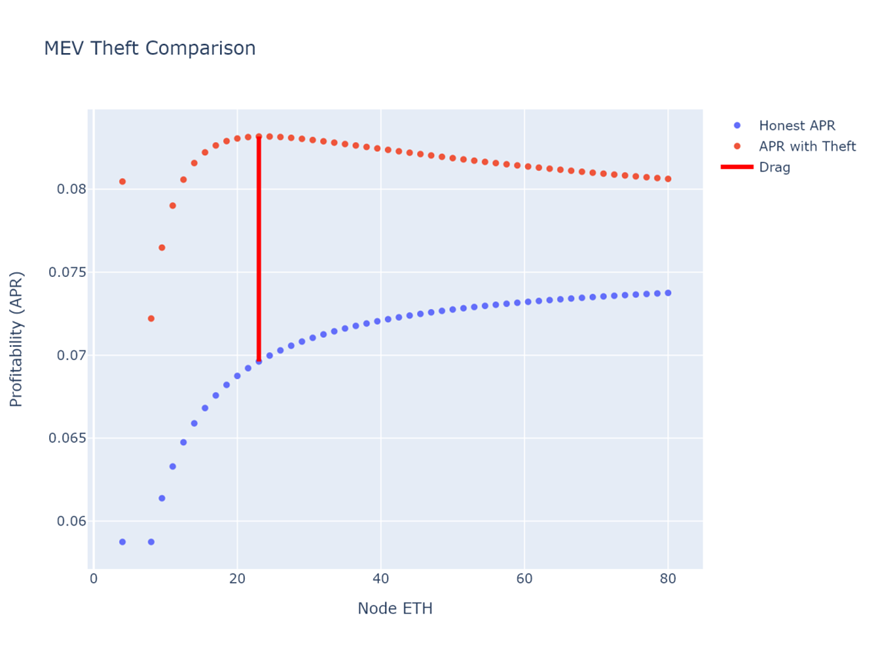

Putting together the bond curve, forced exits, and node level penalties: An example comparing Honest APY vs. APY with MEV-theft is shown in Figure 1 below. You can see how the first validator (only a 4 ETH bond) has the significantly highest amount of drag for the protocol, but if a thief wanted to maximize their APY, they would create 12 validators. At 12 validators the drag for the protocol is significantly reduced (vs at a single validator), and the protocol is much safer since it would have the ability to recover 23ETH of node operator bond from the entire megapool, instead of just 4 ETH of node operator bond from a single validator.

Figure 1 - Profitability with and without MEV theft

Figure 1 - Profitability with and without MEV theft

Forced Upgrades

Saturn 1 includes the ability to force node operators to upgrade the delegate contracts used to manage their validators. This serves as a way to (a) limit long-term technical debt accrual and (b) rely on upcoming functionality (notably validator forced exits). In order to give node operators plenty of freedom to choose how they operate, there is a multi-month grace period before the delegate must be upgraded.

Express Queue

With the Saturn Upgrade, existing node operators who want to migrate will need to exit their legacy validators and create new validators under a megapool contract. This churn, along with the potential for node operator supply to outpace rETH demand (due to things like the introduction of ETH-Only validators) could lead to a significant node operator queue. To support decentralization, protocol safety, and the health of the Ethereum network the Saturn Upgrade also introduces an express queue.

To enter the express queue you must use an express queue ticket, and tickets are distributed to favor both small node operators and existing node operators. Two1 express queue tickets will be given to all node operators (including all new node operators post-upgrade), giving node operators preferential access for their first validators. Additional express queue tickets will also be given to all existing node operators (enough tickets to allow for express migration of all bonded ETH to 4-ETH bond validators1).

The express queue works as a parallel queue that moves twice1 as fast as the standard node operator queue. ETH from the deposit pool is matched with validator deposits by taking alternating turns matching from the express queue and the standard queue. On each express queue turn two1 validator matches will be made, but on each standard queue turn only one validator match is made (this is what causes the express queue to move twice1 as fast). If a queue is empty, those matches will be skipped.

-

Initial specifications are listed for simplicity, but these values could be changed if necessary ↩