Foundation of the Tokenomics Rework

Protocol Revenue

For this section we’ll make two simplifications throughout:

To minimize text/diagram complexity, we assume “Voter Share” as the value capture method for the surplus share. Please see RPL Value Capture Options for alternatives and a discussion of their impacts. We assume the proposed initial settings with 5% no_share and 9% voter_share; please keep in mind that the system is meant to listen to the market – therefore these are likely to change over time.

For clarity, we use 8-ETH bonds in the comparison sections to get an apples-to-apples contrast against current 8-ETH minipools. The tokenomics rework includes changes to enable 4-ETH bonds (and later a mix of 4-ETH and 1.5-ETH bonds), later described in the Lower Bonds and Capital Efficiency section.

Overview

There is only one source of revenue for the protocol, the fee charged to rETH holders. In the current system, this is 14%, paid to node operators, who are required to bring a bond of both ETH and RPL. The proposed rework changes things by creating 2 categories of rewards to distribute this revenue:

- NOs (ETH) - “Node Operator Commission Share”. This is paid to all node operators (NOs) in a similar manner as existing validators. One difference is that your eligibility to receive from this share depends only on your ETH, not on your RPL (where previously the node operator commission required an initial minimum requirement of both ETH and RPL). This change allows ETH-Only node operators.

- NOs (RPL) - “Voter Share”. This share is collected from all megapool validators and distributed to participants based on their proportional share of vote-eligible RPL staked in megapools. If you stake RPL as a node operator (NO), your RPL is eligible for voting, so you would receive a proportional share from this pot of revenue. This revenue also grows with rETH supply, where growth would allow the same supply of vote eligible RPL to earn more ETH.

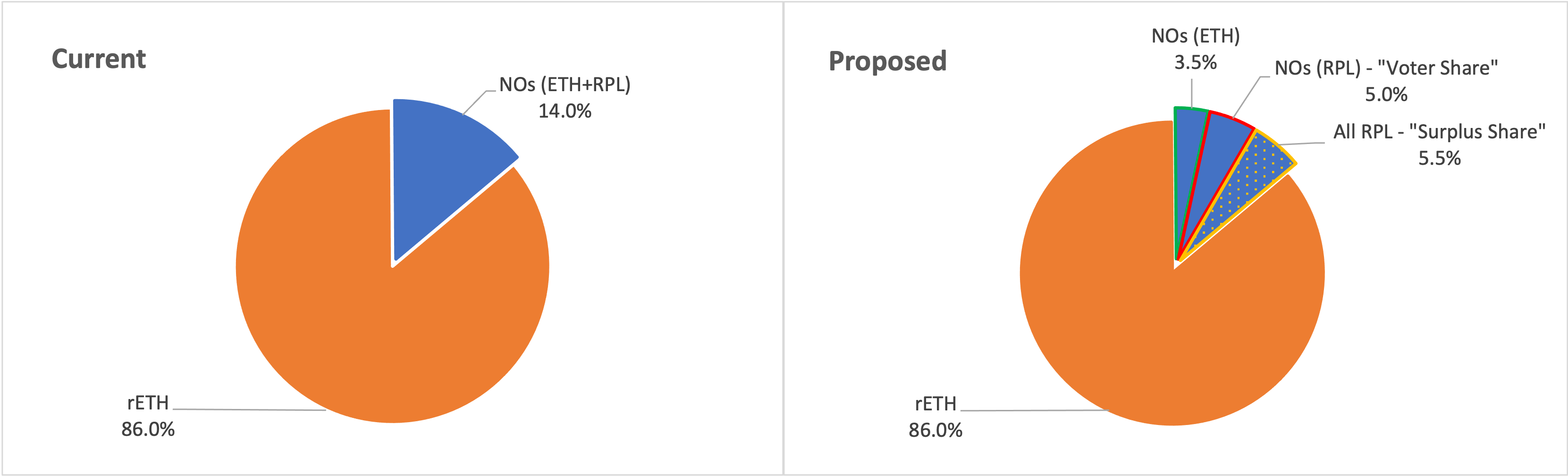

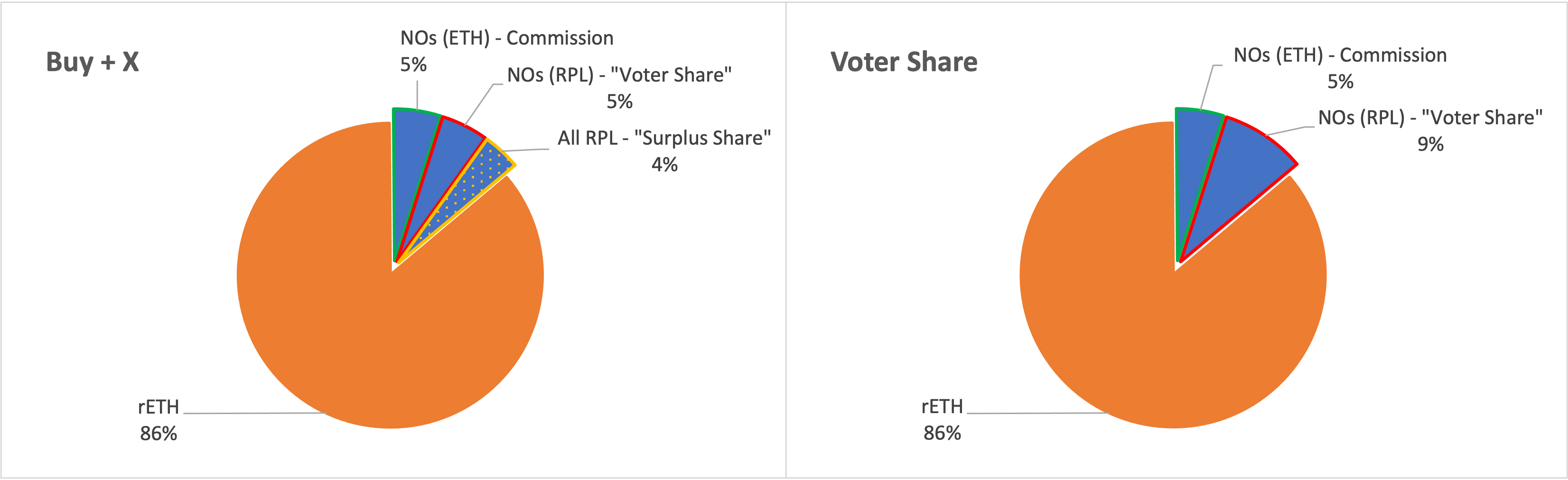

Importantly, the same participant may be eligible to benefit from both categories. As an example take the node operator in existing tokenomics, represented in Figure 1 on the left pie chart in blue. You can see how an equivalent participant shows up in blue in the new tokenomics on the right pie chart. Their ETH earns from the Node Operator Commission Share, which is initially 5% in the current proposal. Their staked RPL earns from the Voter Share, which is initially 9% in the current proposal.

Figure 1 - Current and Proposed tokenomics pies

Figure 1 - Current and Proposed tokenomics pies

One key difference is the removal of the minimum RPL stake requirement. Previously, this was the primary source of value capture for RPL, and RPL inflation rewards were used as an incentive for node operators to maintain at least the same level of RPL exposure that was initially required. With the proposed rework, RPL inflation to node operators is no longer required since node operators are free to choose any level of RPL exposure they are comfortable with, and RPL value capture instead comes directly from protocol revenue. RPL inflation to node operators will be kept for Saturn 1 to help smooth the transition (the rewards formula will be tweaked to eliminate the cliff by extending the minimum to 0% borrowed from the current 10%). With Saturn 2, we stop rewarding node operators with RPL from inflation and are thus able to reduce the rate of inflation of the RPL token from 5% to 1.5% (which supports its long-term value).

Previously, Rocket Pool targeted a very narrow window of participants to support the protocol by forcing multiple requirements of the same individual:

- Technical expertise to perform node operator duties

- The minimum ETH requirement

- The minimum RPL requirement

- Ideally a particular ratio of ETH to RPL to maximize validators for a given amount of capital

In reality, there may be demand for more limited forms of participation from individuals who may not meet all four requirements. By structuring the incentives to support that demand, there is a greater opportunity to grow the pie of total protocol revenue, which would benefit all participants in the protocol. Some examples include:

- The market can now be opened to ETH-Only node operators

- Node operators can choose the degree of RPL exposure they feel comfortable with (no more cliff)

- A reduced rate of inflation makes RPL more attractive

- For some RPL Value Capture Options, RPL holders benefit directly from protocol revenue

Node Operator Perspective

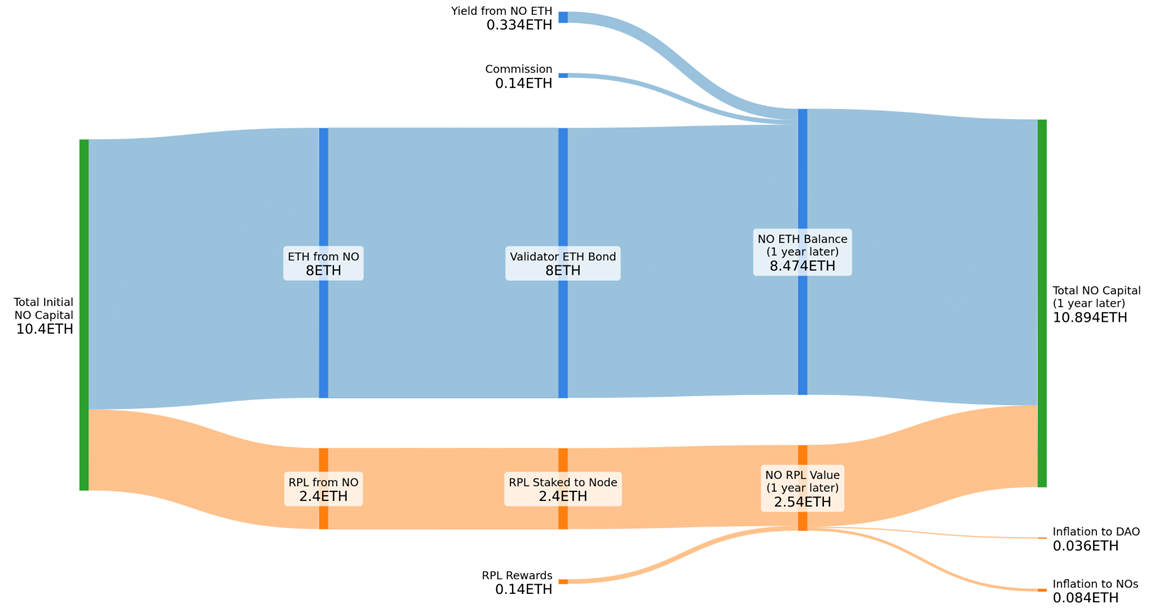

Let’s examine things from a node operator perspective, starting with existing tokenomics. In the diagrams below, blue will represent ETH and orange will represent RPL (with the value still shown in ETH). As a reminder, we are using 8-ETH bonds to compare apples-to-apples against the existing tokenomics. The tokenomics rework will include 4-ETH bonds (and later a mix of 4-ETH and 1.5-ETH bonds.)

For this sub-section, we make three simplifying assumptions. First, a solo staking APY of 4.17% was chosen to help get round numbers – this means each validator generates 1 ETH per year on the 24 borrowed ETH (for context, currently observed solo APY is ~3.8%). Second, where RPL exists, the RPL/ETH market cap is assumed to stay flat. Finally, we assume all users are using the same type of pool.

Current minimum LEB8 allocation

Figure 2 - Current LEB8 Sankey Diagram

Figure 2 - Current LEB8 Sankey Diagram

The node operator earns solo staking APY on their bond (0.334 ETH), 14% commission on the borrowed ETH (0.14 ETH), and RPL rewards (0.14 ETH)1. Meanwhile, they lose RPL value to inflation going to node operators for RPL rewards (0.084 ETH) and inflation going to DAO expenses (0.036 ETH).

The end result is that the node operator would make 1.14x solo staking APY right now. At maturity, RPL would approach ~100% staked, at which point RPL rewards and Inflation to node operators cancel each other out resulting in 1.01x solo staking APY. Back to the current state, if a node operator loses eligibility for RPL rewards (which often happens due to falling RPL/ETH price ratio), the loss of the 0.14ETH in RPL rewards would result in 0.82x solo staking APY.

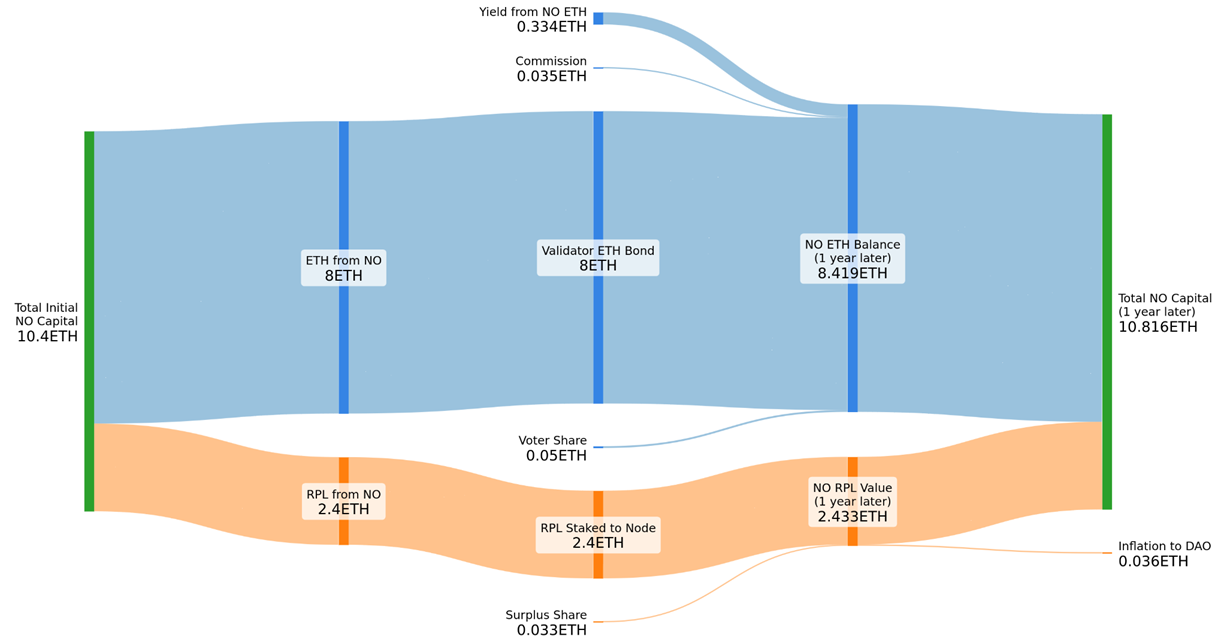

Proposal using current minimum LEB8 allocation

Figure 3 - Proposal w/minimum LEB8 Allocation Sankey Diagram

Figure 3 - Proposal w/minimum LEB8 Allocation Sankey Diagram

The node operator earns solo staking APY on their bond (0.334 ETH), 5% commission on the borrowed ETH (0.05 ETH), and 9% revenue share on their vote-eligible RPL (0.09 ETH)2. Meanwhile, they lose RPL value to inflation going to DAO expenses (0.036 ETH). At first glance the only difference from the current LEB8 example is the splitting of rewards into two categeories, and the removal of RPL issuance rewards (reminder: RPL issuance rewards will continue in Saturn 1 but discontinue in Saturn 2).

The end result is that the node operator would make 1.01x solo staking APY right now. Note that voter share depends on your exposure to RPL relative to other node operators. Eg, if half of the validators are ETH-Only and half look like this node operator, then the voter share reward to this node operator would double to 0.18 ETH; that would result in 1.22x solo staking APY. This dynamic will be explored further with the ETH-Only allocation example and the Case Study below.

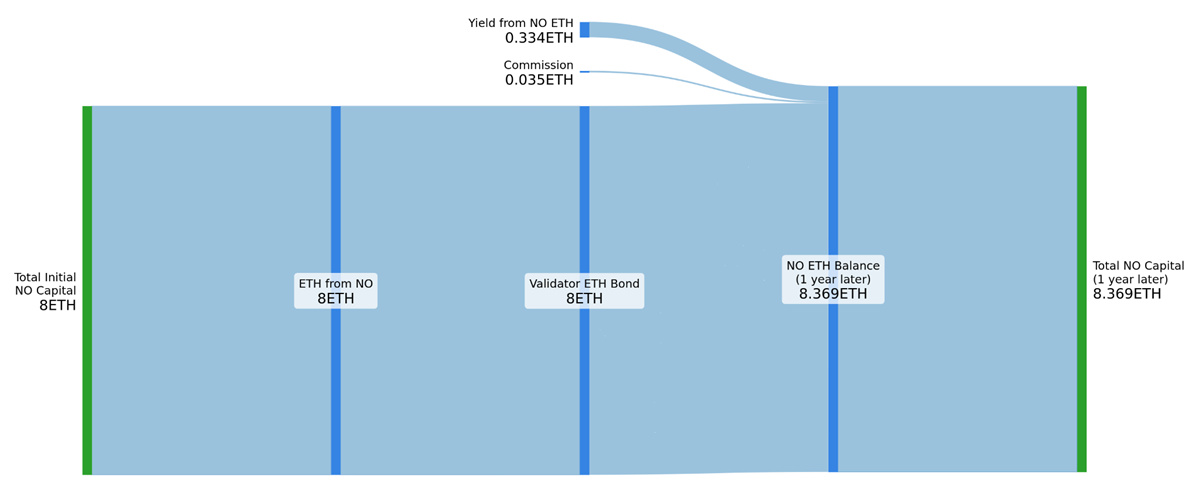

Proposal using ETH-Only allocation

Figure 4 - Proposal ETH-Only Sankey Diagram

Figure 4 - Proposal ETH-Only Sankey Diagram

The node operator earns solo staking APY on their bond (0.334 ETH), and 5% commission on the borrowed ETH (0.05 ETH).

The end result is that the node operator would make 1.15x solo staking APY right now.

Case Study: ETH-Only is Preferred by Node Operators

Proposal Case Study, Reference

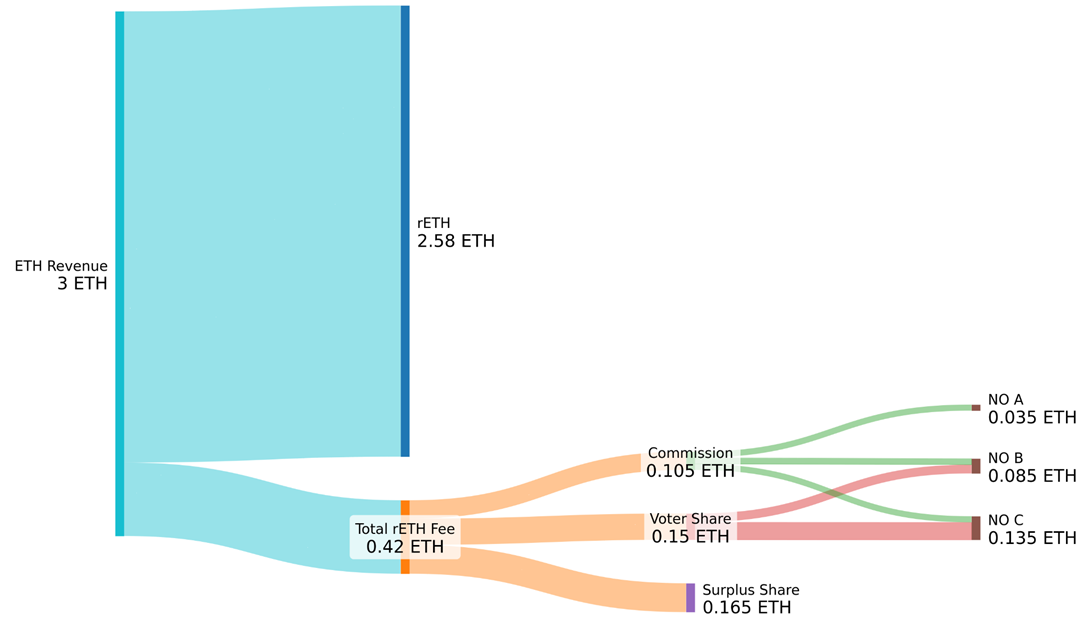

Figure 5 - Case Study Reference Sankey Diagram

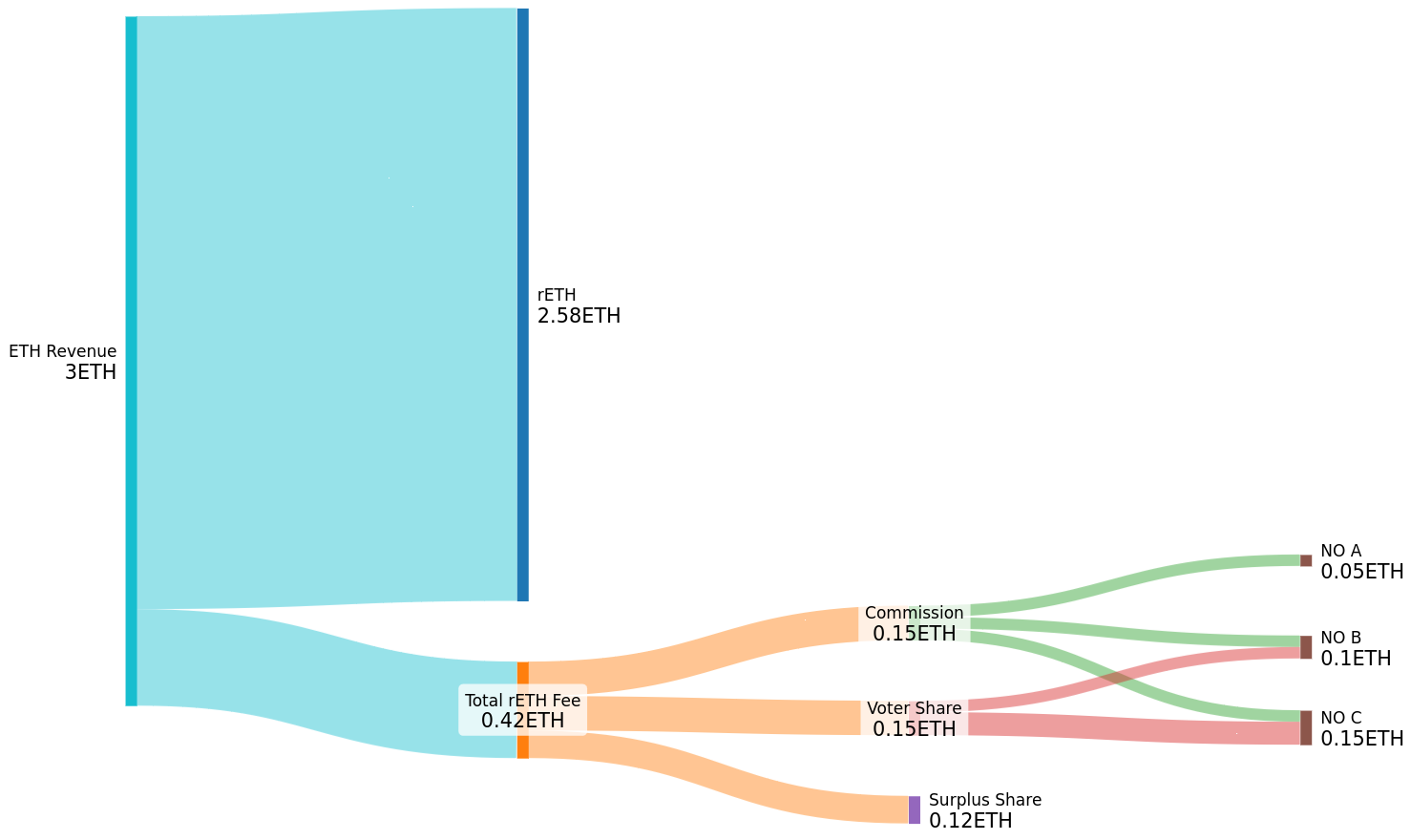

Figure 5 - Case Study Reference Sankey Diagram

In this case study, we have 3 node operators (NOs). (A) has 8 ETH and no RPL staked. (B) has 8 ETH and 6 ETH worth of RPL staked. (C) has 8 ETH and 15 ETH worth of RPL staked (note that vote-eligible RPL is capped at 150% of bonded ETH. This leads to NO C earning twice as much from “Voter Share” as NO B).

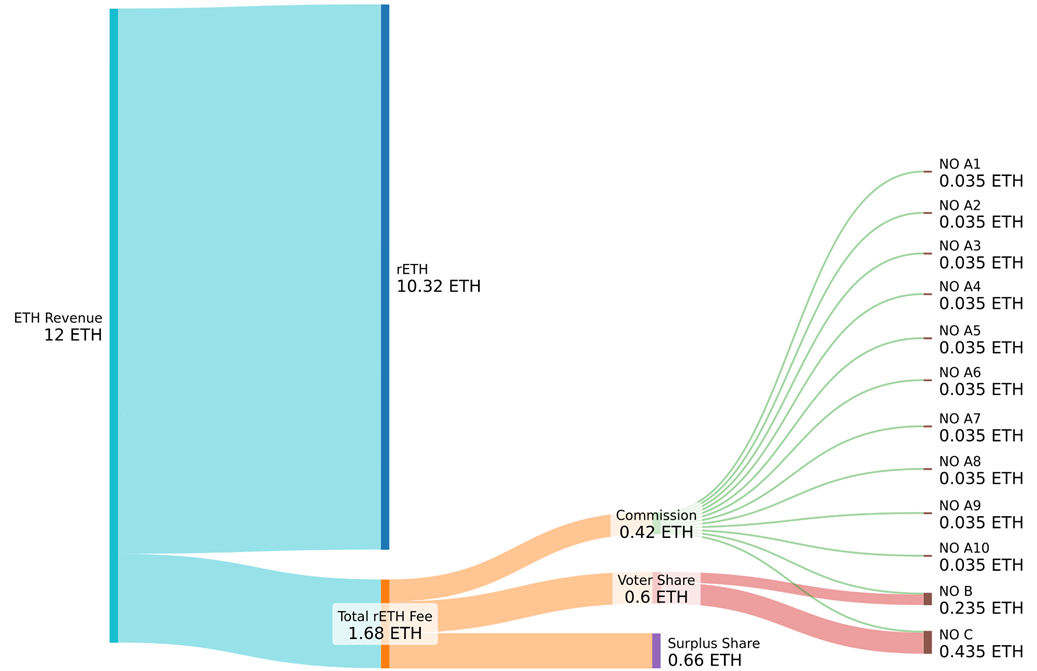

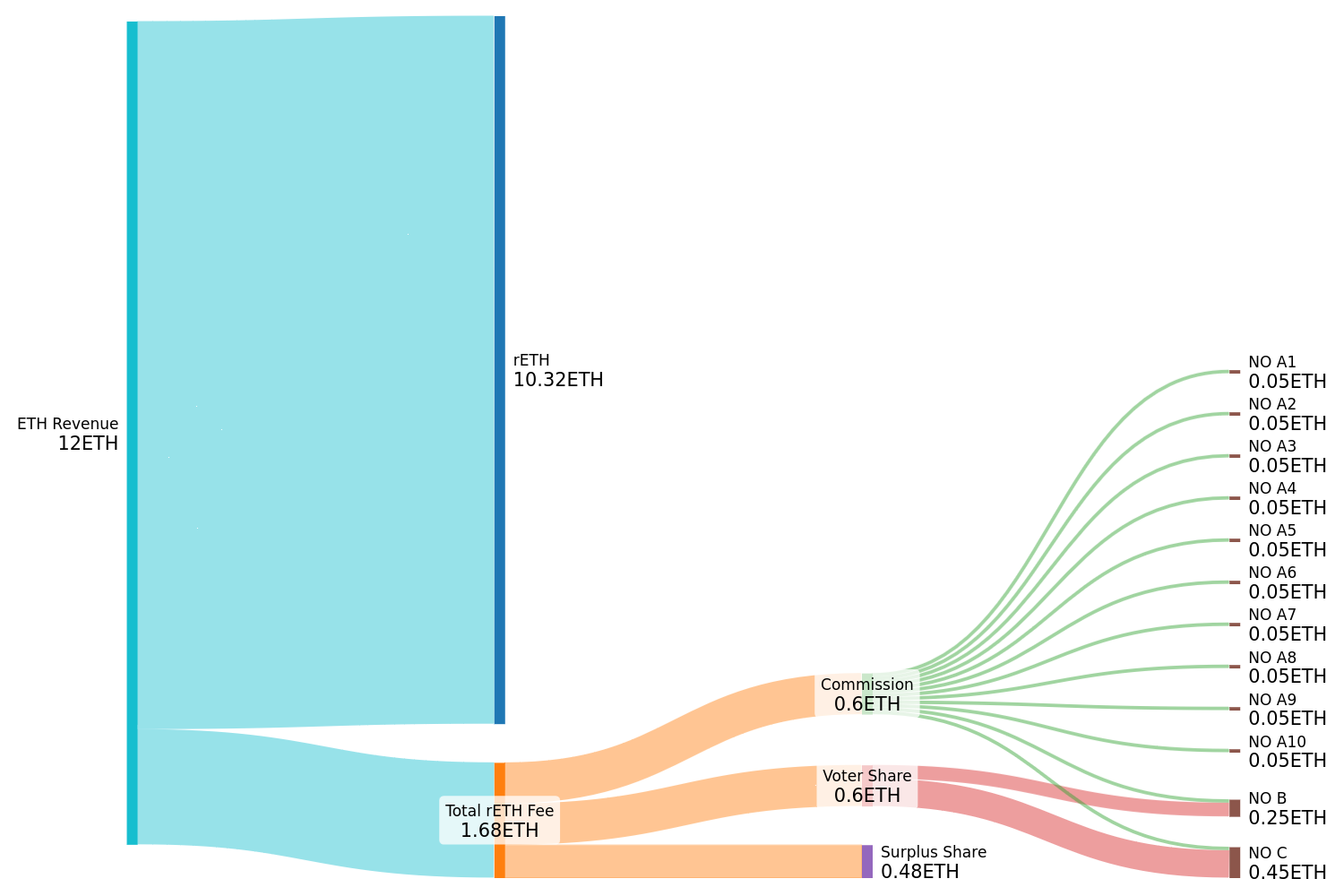

Proposal Case Study, 9 more ETH-Only Node Operators join

Figure 6 - Case Study ETH-Only Growth Sankey Diagram

Figure 6 - Case Study ETH-Only Growth Sankey Diagram

Now we see 9 more NOs identical to (A) join. As you can see, there’s a self-balancing effect. Voter Share increased 4x while the amount of staked RPL stayed the same. As a result, NO B and C earn 4x more from Voter Share (even though they have the same RPL). In short: node operators unwilling to take on RPL exposure still grow the protocol’s ability to meet rETH demand, and higher rETH supply makes RPL exposure more attractive.

Lower Bonds and Capital Efficiency

Zooming all the way out, the total revenue is reth_commission*reth_tvl_in_validators. To get total ROI, we divide that by total investment, which is (bonded_eth + rpl_mcap_in_eth). From this we can see that there are 4 ways for total ROI to improve if all else is held equal: (1) increased rETH commission, (2) increased rETH supply, (3) less bonded ETH, and (4) lower RPL market cap. Lower bonds are important because they are the only way to execute on (3) without decreasing rETH supply. In fact, lower bonds also help hit (2) by making it possible to service more rETH supply given the same node operator investment.

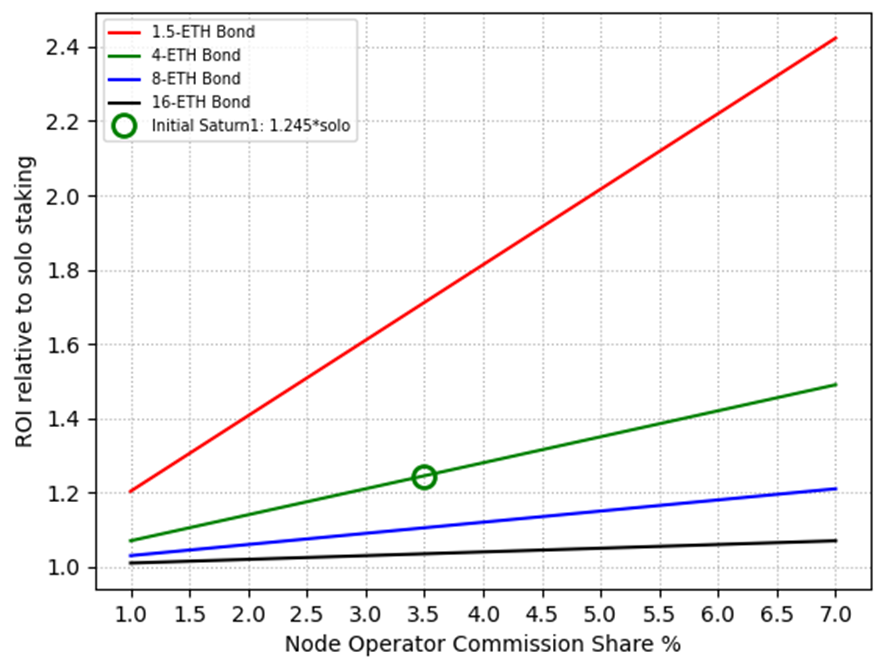

ETH-Only Validator ROIs (Saturn 1)

Zooming in to a single operator, the easiest way to look at the impact of lower bonds is by considering ETH-Only validators and looking at their ROI. As we can see - we get dramatically higher ROIs for the same commission (or, equivalently, can get the same ROI with dramatically lower commission). The takeaway is simple from a capital efficiency point of view – smaller bonds are better.

Figure 7 - ROI based on Node Operator Commission Share and ETH Bond per validator

Figure 7 - ROI based on Node Operator Commission Share and ETH Bond per validator

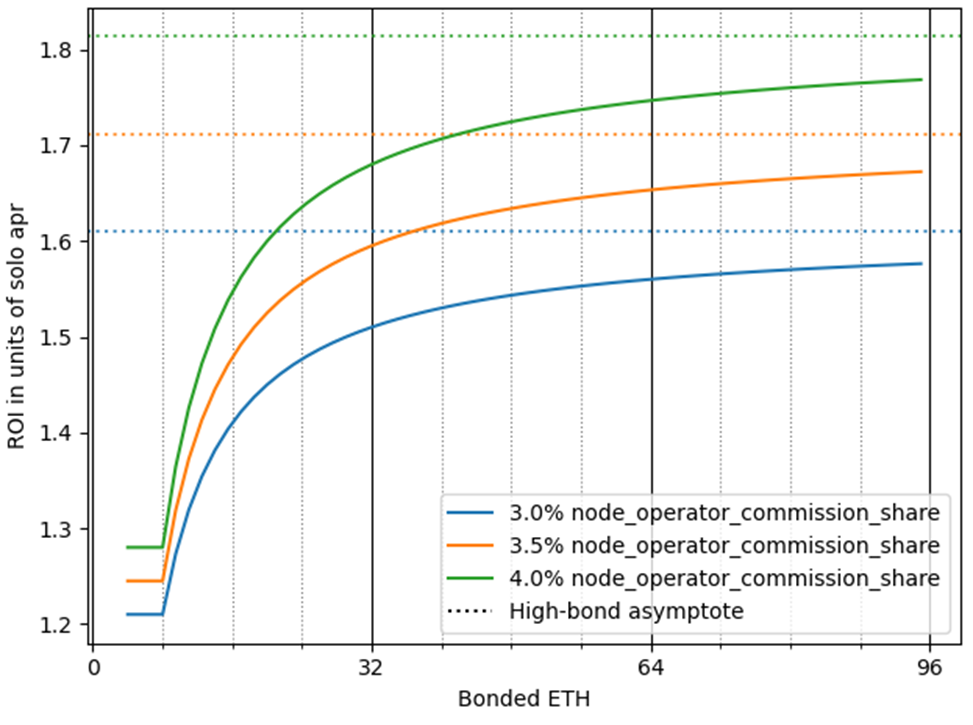

ETH-Only Validator ROIs (w/proposed bond curve in Saturn 2)

Despite the “smaller is better” takeaway from above, there are real limits. Security requires us to have enough bond per validator to align incentives and mitigate damage in cases of slashing, abandonment, and MEV theft. The result is a proposal that starts out with 4 ETH per validator for the first 2 validators; thereafter, the bond is 1.5 ETH per validator. We can see that ROI improves rapidly as a node operator adds validators, and then starts to flatten out. Note that this proposal requires forced exits to be available for security, which is why it cannot be implemented until Saturn 2.

Figure 8 - ROI based on Node Operator Commission Share and total Bonded ETH

Figure 8 - ROI based on Node Operator Commission Share and total Bonded ETH

Keep in mind that if this is extremely attractive, UARS allows us to improve the balance by reducing node_operator_commission_share and increasing another share. Similarly, if it’s not attractive enough, node_operator_commission_share can be increased at the cost of decreasing another share. Do note that there’s quite a significant impact to ROI with a small change in share – eg, at 64 ETH bonded, we see a 1% change in share causes a ~10% change in ROI.

UARS and Listening to the Market

Current State

Fixed Commission

Currently, Rocket Pool has an individual validator fixed commission model. This means each validator will always charge the same commission for the lifetime of that validator (or until the node operator opts into an upgrade that changes the commission). With the existing system, 100% of the rETH commission goes to node operator commission, so the protocol’s average rETH commission only changes slowly, as new validators are added or node operators opt to upgrade their validators to a new commission.

Fixed Protocol Fee

The RPL staking minimum serves as an indirect protocol fee. Since it’s fixed at 10% of borrowed ETH, it represents a fixed fee. The protocol’s average fee is resistant to change, even if we did vote a change in. The impact of such a change would only be realized slowly, as new validators are added, or node operators withdraw RPL (which may require exiting and recreating validators in some cases).

Proposal

UARS (Universal Adjustable Revenue Split)

One major change in the proposal is that the Revenue Split variables will apply universally across all megapools, and they will be adjustable by the protocol without requiring a validator exit and migration to new validators with a different fixed setting. Universal settings can allow changes that benefit the protocol and the participants in the protocol without perverse incentives (eg, in the Current State, there can be a tragedy of the commons situation where each individual node operator would avoid opting into a lower commission, even though they’d all prefer it if everyone opted that way).

Choosing Revenue Split Sizes

Ultimately the pDAO (node operators with staked RPL) controls the Revenue Split variables and has the ability to change them through voting.

Some abstract guidelines the pDAO should consider when deciding the sizes of the Revenue Splits:

- Node Operator Commission Share MUST be high enough to attract rETH supply. If this share is not high enough to attract some supply, the protocol is non-functional. If this share is not high enough to attract enough supply to meet demand, the protocol is kept smaller than it could be.

- rETH Share MUST be high enough to attract rETH demand. If this share is not high enough to attract some demand, the protocol is non-functional. If this share is not high enough to attract enough demand to meet supply, the protocol is kept smaller than it could be.

- Voter Share can be seen through two lenses

- It MUST be high enough that RPL holders choose to stake their RPL. If there is not enough vote-eligible staked RPL, then the protocol can become at risk for governance attacks.

- RPL holders are incentivized to maximize something along the lines of

voter_share * rETH_TVLso that each unit of RPL earns the most ETH. This means voters generally have an incentive to balance a highvoter_sharewith growing the protocol (eg, by accepting a lowervoter_shareand spending on rETH supply and/or rETH demand).

With these factors in mind, the pDAO should pay attention to the market, and take actions as necessary to ensure healthy sustainable settings.

Listening to the Market

There are natural checks and balances that allow “non-voting” participants to create market pressures. Some examples:

- If node operators don’t find holding RPL attractive, they may still opt to run ETH-Only. This grows total revenue and makes staking RPL more attractive. See Case Study: ETH-Only is Preferred by Node Operators.

- If rETH holders find rETH unattractive, they can sell (or not buy) rETH. This limit to growth also limits the value of RPL.

- If ETH-Only node operators don’t find the commission attractive enough, they can choose a competitor who provides them with higher compensation for their services.

- If RPL holders don’t find the value capture attractive enough, they can sell (or not buy) RPL; this will decrease the ETH value of RPL, which improves the ROI in ETH terms.

RPL Value Capture Options

This section describes three potential implementations for how the “Surplus Share” described in Protocol Revenue can be used to drive value to RPL.

We will use “Voter Share” as a simple-to-implement option for Saturn 1 so that the dev team can progress. After additional modeling and discussion, but before Saturn 1 goes live, we will vote on the RPL Value Capture Option to use for Saturn 2.

Buy + Burn

For buy + burn, a share of ETH revenue is used to buy RPL on the open market. The RPL is then burnt to permanently remove it from the total supply of RPL. In theory, the market cap of RPL should be unchanged by this, while the supply is reduced, which would mean the price per RPL token increases (by its share of the ETH revenue). The implementation uses a time-averaged market price and avoids large steps in available burn liquidity to limit opportunities for someone to game the system and steal value.

Buy + LP

For buy + LP, a share of ETH revenue is used for single-sided deposits into an RPL/rETH Liquidity Pool (note that a single-sided deposit is equivalent to an RPL buy followed by an asset-weighted deposit).

The liquidity pool is a weighted pool with 90% RPL weight and 10% rETH weight. This means that ~90% of revenue would go to driving value to RPL directly, while 10% would go to building deep protocol-owned liquidity for RPL. The other two options do not build liquidity – this means the pDAO would need to fund that liquidity some other way (or not have much).

Unlike Buy + Burn, no time averaging on price is possible since the liquidity pool is a live market. As a result, the implementation will take even more care to avoid large steps.

Voter Share

In this case, no share of ETH revenue is used to buy RPL (which means unstaked RPL does not directly benefit from the ETH revenue). Instead, the equivalent share of ETH revenue is simply used to have a larger voter_share which is distributed according to vote-eligible RPL staked to megapools. This means only node operators are natively able to benefit from RPL’s value capture directly. This has some positives (direct ETH received instead of indirect value captured; avoids some complexity in implementing one of the above options) and some negatives (much smaller total addressable market). Note that it may become possible to benefit without being a node operator via abstractions (eg, NodeSet’s proposed xRPL).

What would plots look like under other options?

As we noted initially, “Voter Share” was assumed for this explainer.

Here we show the pie charts for “Buy + x” on the left and “Voter Share” on the right. Note the new “Surplus Share” slice, which is drawn as blue with gold dots. The gold dots represent the new beneficiary of protocol revenue (unstaked RPL), and the blue represents the same beneficiary as before (node operators with staked RPL).

Figure 9 - Proposed tokenomics pies for "Buy + x" and "Voter Share" respectively

Figure 9 - Proposed tokenomics pies for "Buy + x" and "Voter Share" respectively

Here we show sankey diagrams of the Case Study Reference example from before but this time including the “Surplus Share” flow, which could be used for Buy + Burn or Buy + LP. This share would benefit all RPL (including both staked and unstaked RPL).

Figure 10 - Case Study ETH-Only Growth Sankey Diagram with Surplus Share

Figure 10 - Case Study ETH-Only Growth Sankey Diagram with Surplus Share

Figure 11 - Case Study ETH-Only Growth Sankey Diagram

Figure 11 - Case Study ETH-Only Growth Sankey Diagram

-

RPL rewards are modeled by calculating RPL yield as:

RPL APY = [% RPL inflation to node operators] / [% of staked RPL supply] = 3.5%/60% = 5.83% 5.83% * 2.4ETH = 0.14ETH↩ -

The example shown assumes this node operator represents the average staked RPL exposure of all node operators, so they earn average Voter Share rewards of 9% ↩