Saturn 0 (Tokenomics Rework Prelude)

Context and Motivation

With the DAO having voted for the Saturn upgrade, the fundamental value of RPL will primarily be based on protocol TVL instead of a bonding mechanism as it had been. As a prelude to that, Saturn 0 focuses on making node operation more attractive by allowing minipool creation without RPL and removing the cliff for RPL issuance rewards. Saturn 0 avoids smart contract changes1 to allow implementation in a matter of weeks (much sooner than waiting until Saturn 1).

Contents

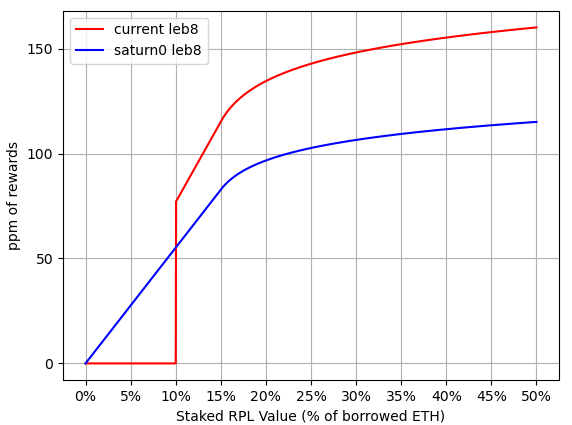

RPL Issuance Rewards

Saturn 0 will remove the cliff for RPL issuance rewards. This means RPL issuance rewards will be adjusted such that Node Operators earn the maximum APY for staked RPL positions worth 0-15% of borrowed ETH.

Figure 1 - RPL Issuance Rewards Structure

Figure 1 - RPL Issuance Rewards Structure

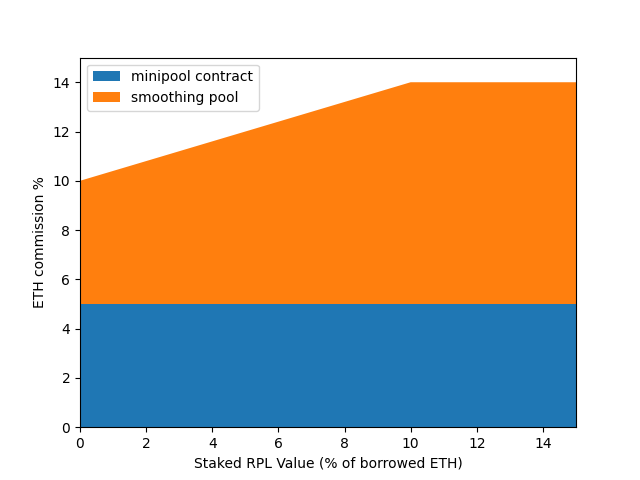

ETH Commission Structure

Newly-launched Saturn 0 minipools will receive a commission ranging from 10% to 14%. This consists of 5% from the minipool contract and a dynamic commission boost ranging from 5% (no RPL staked) to 9% (staked RPL valued at ≥10% of borrowed ETH). Dynamic commission uses the smoothing pool for distribution, so opting into the smoothing pool is strongly recommended for Saturn 0 minipools.

For reference, ETH returns are:

Figure 2 - ETH Commission Structure

Figure 2 - ETH Commission Structure

Transitioning to Saturn 1

As previously mentioned, the goal of Saturn 0 is to capture TVL. More precisely, the goal is to capture TVL in megapools (since megapools contribute to protocol-wide revenue sharing). This is addressed three ways:

- Node operators will want to migrate to megapools to get higher yield. For example, an LEB4 at 5% commission yields 1.35x solo staking APY. This is made possible by Saturn 1+’s lower bond per validator (and thus greater capital efficiency). Things are further improved by the lower operational costs due to a single megapool contract.

- On the 5th reward snapshot after Saturn 1 is released, dynamic commission is reduced to 0%, resulting in 1.15x solo staking APY from contract commission only. This serves to increase the yield advantage of migrating.

- Finally, if a node operator still does not migrate, there is no real issue for the protocol. With dynamic commission set to 0%, the remaining minipools serve to boost rETH APY by reducing its effective commission (similarly to boosting the

reth_sharecomponent in Saturn 1+).