Abstract

This proposal establishes a contract that holds ETH from protocol revenue and allows for RPL to be burned in exchange for that protocol ETH. This provides direct utility to the RPL token.

Specification

- A share of the revenue from borrowed ETH SHALL be directed to a smart contract (the burn contract) for this burn (see RPIP-46)

- Any user SHALL be able to call a function in the burn contract to get ETH from the burn contract in exchange for RPL

- Any RPL exchanged this way SHALL burned using the RPL token’s

burnorburnFromfunctions - The swap price SHALL be based on an on-chain oracle

Motivation

Ongoing protocol development and maintenance of Rocket Pool is funded by RPL inflation. Given this truth, a higher RPL price translates to more resources available for the development and maintenance of the protocol. This proposal intends to drive value to the RPL token via a buy-and-burn mechanism.

This RPIP is part of a set of proposals motivated by a desire to rework Rocket Pool’s tokenomics to ensure the protocol’s continued value, development, and longevity. For more details, see the supporting documentation here.

Implementation thoughts

There have been previous buy+burn mechanics susceptible to gaming. To that end, here’s an example design that focuses on avoiding discontinuities by smoothly unlocking the funds available for exchange.

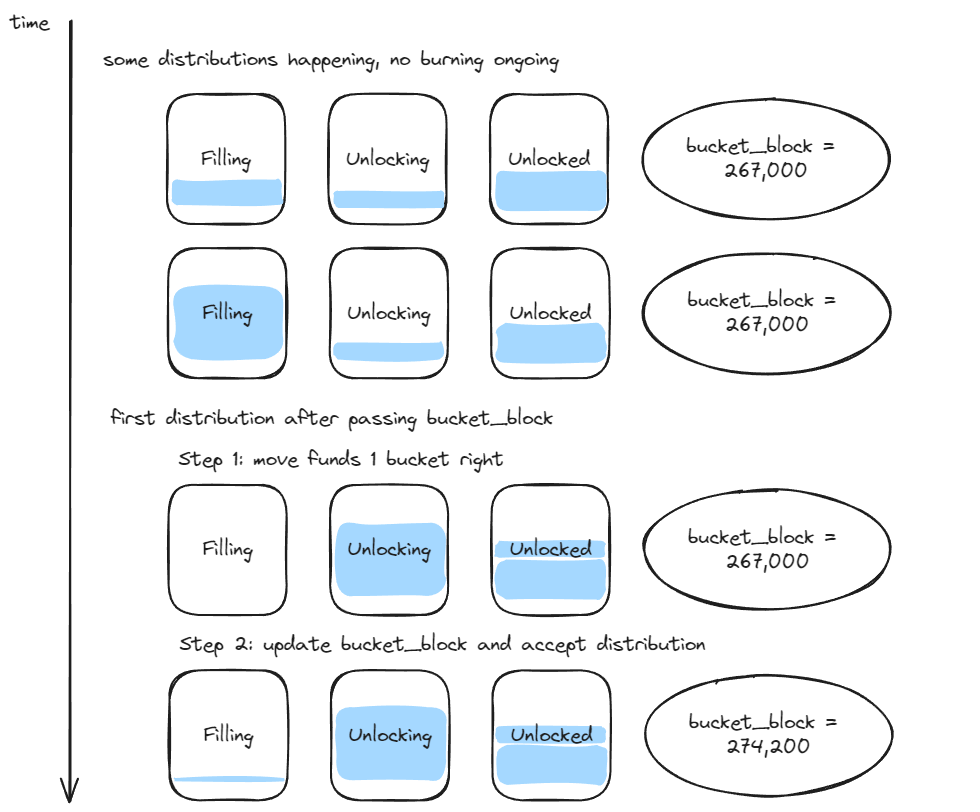

The way this works is that:

- New distributions go into the Filling bucket

- After one

bucket_periodhas passed, upon the next distribution:- Move Unlocking to Unlocked

- Move Filling to Unlocking

- Increment bucket_block by one

bucket_period(repeat as needed untilbucket_block>current_block) - Put the distribution into filling

- The contract will have

Unlocked + Unlocking + FillingETH in it - The contract will allow burning RPL against

Available = Unlocked + (Unlocking*UnlockingRatio)ETHUnlockingRatio = 1 - ((bucket_block - current_block)/bucket_period)

- The swap price will be based on a long Uniswap TWAP

- For safety, the protocol should ensure we have enough protocol-owned liquidity in that Uniswap ETH/RPL pool

- The swap price gives

rpl_to_eth_oracle_price * (1 + bonus_per_unlocked_eth * Available)ETH per RPL bonus_per_unlocked_ethshould be set to 0 to start; if we see that certain market conditions cause undesirable ETH buildup, this number should be increased. For example, setting it to .00001 would pay out with a 1% bonus per 1000 Available ETH. This prevents a slowly gaining price from indefinitely accumulating ETH. It’s unclear if this is necessary, but it seems prudent to include the tool.

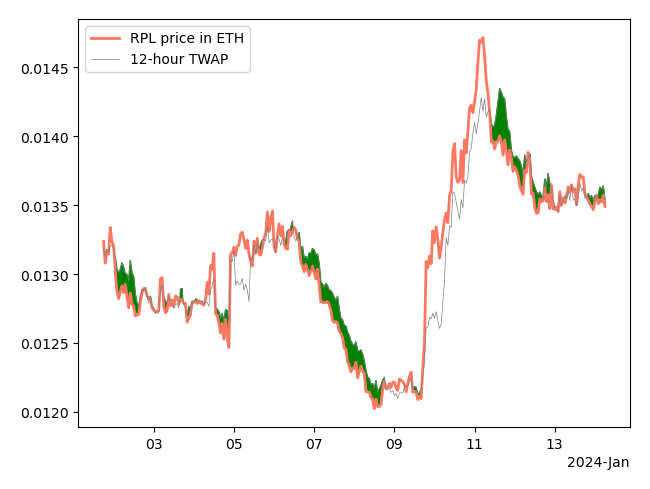

Let’s visualize what being able to burn looks like in practice using real RPL price data and a simulated 12-hour TWAP.

We’d expect to burn all our available ETH at the beginning of a downturn (and thereby reduce its severity since that’s not market sold). We’d also expect to continue burning against new distributions while the price is on a downward slope. On an upward slope, burning is not expected until after the top is reached and we turn around for a bit.

Security Considerations

- The design intentionally presents a small surface area. Any benefit an attacker can accrue is limited by the fact that no user has a privileged position and that value is streamed in smoothly without any discontinuities.

- The cost to attack the oracle depends on:

- TWAP duration - 12 hours is currently in use by the oDAO and seems quite reasonable

- Liquidity depth in the pool - it is strongly recommended that the DAO have some full-range protocol-owned liquidity to set a high-enough floor cost for attacks

- The benefit to an attacker of burning is proportional to the time that they have unique access to a trade; since all users have the same access, this boils down to quick changes in accessible value in the burn contract

- 1 day is proposed as the

bucket_period

- 1 day is proposed as the

Copyright

Copyright and related rights waived via CC0.

Citation

Valdorff, "RPIP-45: RPL Burn [DRAFT]," Rocket Pool Improvement Proposals, no. 45, March 2024. [Online serial]. Available: https://rpips.rocketpool.net/RPIPs/RPIP-45.