Abstract

This proposal dramatically increases the LTV used in the protocol (loan to value; the amount of ETH that can be borrowed per unit of bonded ETH). It does this safely by:

- Enabling megapool-level penalties to mitigate/discourage MEV theft

- Using forced exits as needed (see the required RPIP-44)

- Starting with lower LTV at lower total bonded ETH to mitigate/discourage MEV theft

- Retaining sufficient bond per validator regardless of total stake to mitigate against slashing and abandonment

- Providing increased capital efficiency with greater bond to encourage a node operator to stake as large nodes instead of many small nodes

This proposal also explicitly tries to benefit the smallest node operators in a few ways, in line with the pDAO charter values of decentralization and prioritizing Ethereum health (see RPIP-23):

- We willingly take on somewhat more MEV-theft risk for the smallest node operators (see Rationale)

- We give precedence to small nodes staking some number of initial validators in the Node Operator queue (see proposed RPIP-59)

- There is a small but tangible financial benefit for large stakers that stake as few large nodes instead of many small nodes – this (alongside our vote power, which scales with the square root of vote-eligible RPL) helps preserve the strong governance voice of small node operators

Motivation

The primary motivation for the introduction of smaller ETH bonds in this form is twofold. First, lower ETH bonds allow for the same amount of bonded ETH to support a larger volume of rETH, this helps unlock growth for the protocol, as it has been primarily limited by lack of node operators in the months preceding this proposal. Second, lower ETH bonds increase the profitability of Rocket Pool as a protocol, allowing it to grow and compete favorably with alternative liquid staking providers.

The innovation of a bond curve is motivated by the need to maintain enough stake to mitigate MEV theft, slashing penalties, and abandonment; while meeting the core goal of improved capital efficiency.

This RPIP is part of a set of proposals motivated by a desire to rework Rocket Pool’s tokenomics to ensure the protocol’s continued value, development, and longevity. For more details, see the supporting documentation here.

Specification

This specification introduces the following pDAO protocol parameters:

| Name | Type | Initial Value | Guard Rails |

|---|---|---|---|

maximum_megapool_eth_penalty |

ETH | 612 [PLACEHOLDER VALUE] |

> 300 [PLACEHOLDER VALUE] |

reduced_bond |

ETH | 4 |

Array indexing in this section is zero-based.

- The oDAO SHALL be able to penalize stake at the megapool level when a Penalizable offense is committed by increasing the megapool’s

debtvariable defined in RPIP-43- The oDAO SHALL NOT be able to apply more than

maximum_megapool_eth_penaltyworth of penalties in 50,400 consecutive slots - The pDAO SHALL NOT be able to set

maximum_megapool_eth_penaltylower than 300 ETH [PLACEHOLDER VALUE] - Note that this does not replace RPIP-58, which applies to legacy minipools

- The oDAO SHALL NOT be able to apply more than

- Prior to creating a validator, there MUST be no

debton the megapool- There MAY be a convenience function to use a single ETH payment to pay off existing

debtand create an additional validator

- There MAY be a convenience function to use a single ETH payment to pay off existing

- When a node operator creates a validator, with

ivalidators in the megapool prior to adding:- If

i < base_bond_array.length: the requireduser_depositis the amount of additional ETH to bring the user’s total bond up tobase_bond_array[i] - If

i ≥ base_bond_array.length: the requireduser_depositis the amount of additional ETH to bring the user’s total bond up tobase_bond_array[base_bond_array.length-1] + ( 1 + i - base_bond_array.length) * reduced_bond

- If

- When a node operator removes a validator, with

ivalidators in the megapool prior to removing:- If

i > base_bond_array.length: the node operator share beforedebtis any excess of the user’s total bond abovebase_bond_array[base_bond_array.length-1] + ( i - 1 - base_bond_array.length) * reduced_bond - If

i ≤ base_bond_array.lengthandi > 1: the node operator share beforedebtis any excess of the user’s total bond abovebase_bond_array[i-2] - If

i==1: the node operator share beforedebtis the amount of ETH that would bring the user’s total bond down to 0 ETH

- If

- Bulk validator creation/removal functions MAY be provided; if they are, they SHALL behave the same (with respect to the Rocket Pool protocol state) as multiple individual transactions

- If a node operator has more total bonded ETH in their megapool than would be necessary based on the current settings (eg,

reduced_bondis reduced) and they have nodebt, it SHALL be possible to reduce their bonded ETH and receive ETHcreditfor it creditMUST be usable to create validators in a megapoolcreditMAY be usable to mint rETH to the node operator’s primary withdrawal addressbase_bond_arraySHALL be set to[4, 8]; note that this is NOT a pDAO protocol parameter

Specification taking effect with Saturn 2

This specification converts the following to pDAO protocol parameters:

| Name | Type | Initial Value | Guard Rails |

|---|---|---|---|

base_bond_array |

ETH [] | [4, 8] | != [] |

- Update

reduced_bondto 1.5 ETH

Penalizable offenses

This portion of the RPIP SHALL be considered Living. It may be updated by a DAO vote following the existing rules and conventions for RPIP modifications.

| Offense | Penalty | Added | Updated |

|---|---|---|---|

| MEV theft | theft size + 0.2 ETH | 2024-03-29 | 2024-03-29 |

Rationale

The bond curve is an attempt to get close to maximizing capital efficiency while maintaining safety. It balances capital efficiency with slashing, leakage, and MEV theft risks as described in Security considerations.

“Bond reduction” for credit is explicitly supported so that node operators that deposited under higher requirements are not permanently disadvantaged. At the same time, there is no equivalent support for “bond increase”. This is because those validators are already running and it would need a heavy-handed approach, such as force exiting, to enforce bond increase. Since the bond curve is based on total bonded ETH when depositing, node operators adding new validators would need to add enough ETH bond to match the “bond increased” curve.

Security considerations

- Bond sizes were originally ideated per prior work

base_bond_arrayis chosen to “sufficiently” dissuade MEV theft as a strategyreduced_bondis chosen to “sufficiently” guard against slashing or abandonment risks

- Follow-on work was done in discord

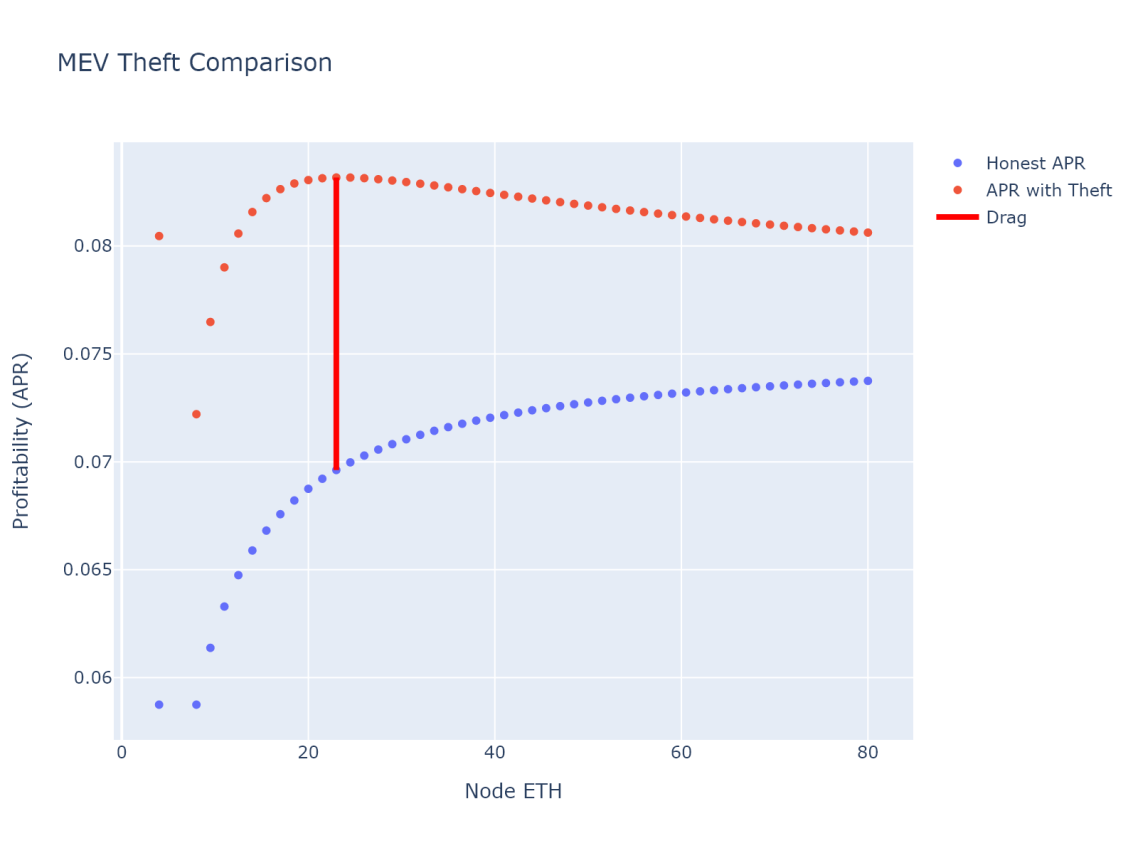

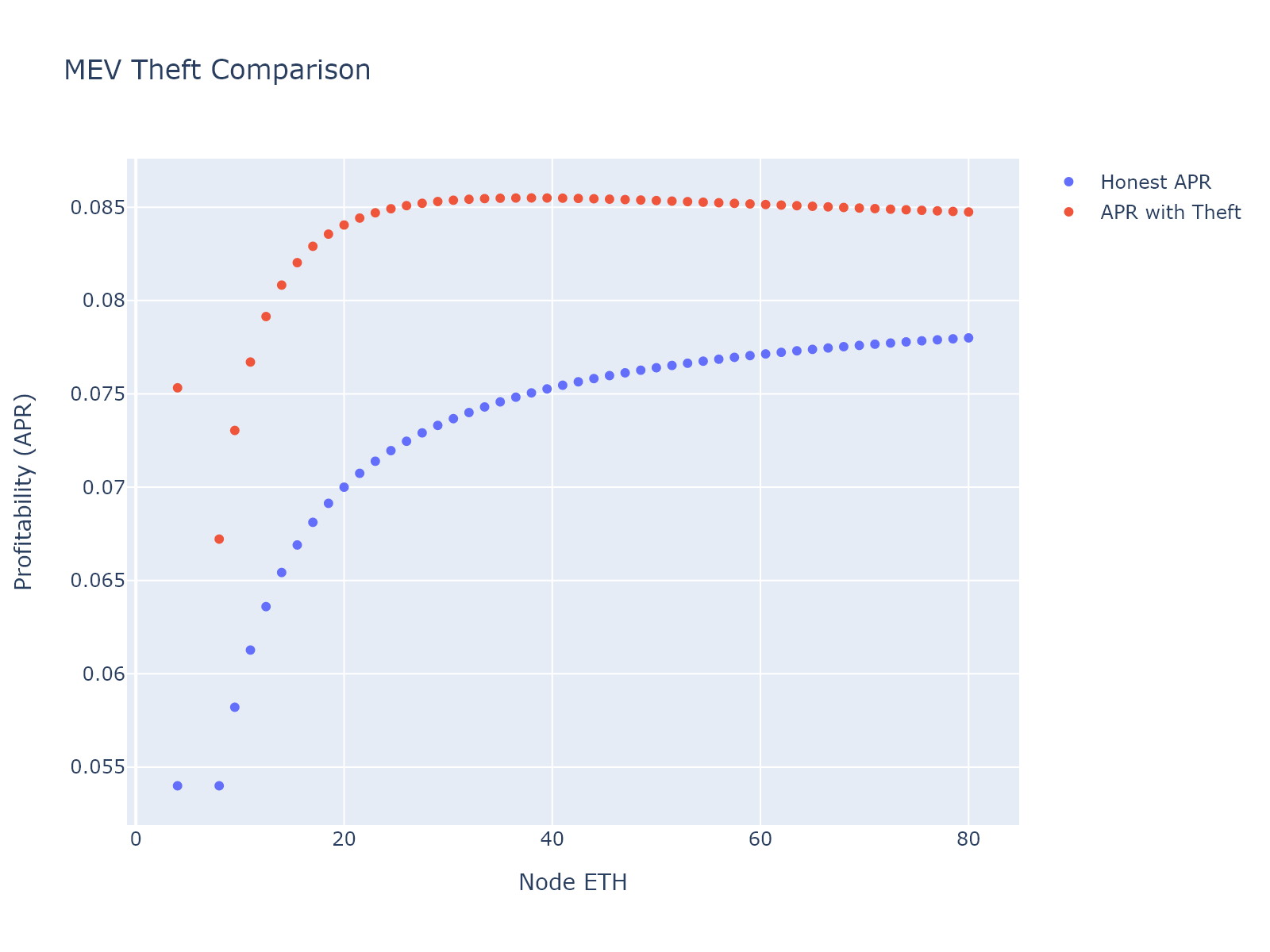

- The plots below show

base_bond_array=[4, 8] andreduced_bond=1.5 with a solo staking APY of 4%. As we can see, MEV theft always increases yield and the impact is heightened at low commission. The reality is that we’ve seen very little of this type of behavior. We may have to change our approach if we see MEV theft increase or if we wish to support node operator commission share under 2.5%. - A moderate step would be to change

base_bond_arrayto a curve that reduces MEV theft advantage in the current context (commission, MEV landscape…) at the cost of user complexity, eg[4.2, 6.8. 9.2. 11.4. 13.5. 15.5. 17.4] - A larger step would be to pass EL rewards to node operators and charge them for the benefit. See eg: Valdorff’s research or Epineph’s forum post

- The plots below show

| 2.5% commission | 5% commission |

|---|---|

|

|

- Minimum size sock puppets are most damaging to the protocol (ie, have the greatest drag), so it’s important that they are not incentivized. Note that the bond curve has been chosen to ensure that this size is not the most efficient for theft. They get the most advantage from theft, but not the highest overall yield from a dishonest strategy.

Copyright

Copyright and related rights waived via CC0.

Citation

Valdorff, "RPIP-42: Bond Curves [LIVING]," Rocket Pool Improvement Proposals, no. 42, March 2024. [Online serial]. Available: https://rpips.rocketpool.net/RPIPs/RPIP-42.